New Delhi, (Asian independent) Economic growth as well as higher revenue receipts are expected to give state governments greater leg-room in FY23.

Besides, it is estimated that despite Covid-19 and populist schemes the outlook on the finances of Indian states is set to improve in FY23.

Notably, greater financial assistance provided by the Centre is expected to tide over any revenue shortfall during the ongoing pandemic phase.

In FY23 budget, the Centre has allocated Rs 1 trillion worth of financial assistance by way of the 50-year interest-free loans.

Further, the Centre has allocated a higher amount of Rs 7.45 trillion as the states share in central taxes in FY22RE.

However, the situation remains acute with Omicron wave slowing down growth momentum.

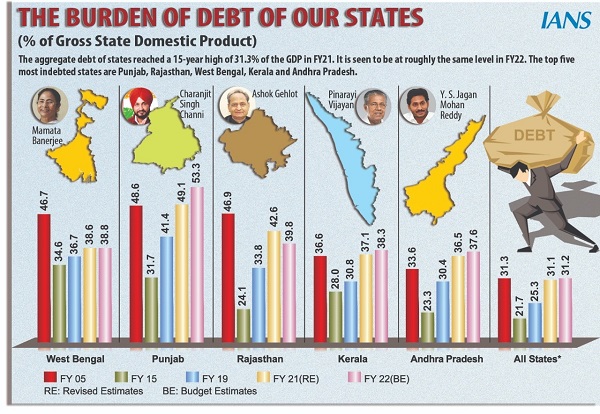

As per a Reserve Bank of India’s study of budgets, the total liabilities of all state governments increased by 14.6 per cent to Rs 60.2 trillion in FY2021 revised estimates (RE) from Rs 52.5 trillion in FY2020.

“Subsequently, the liabilities grew by 13 per cent to Rs 68.0 trillion in FY2022 budget estimates (BE),” said Aditi Nayar, Chief Economist, ICRA.

“As a proportion of GSDP, total liabilities deteriorated from 25.8 per cent in FY2020 to nearly 30 per cent each in FY2021 RE and FY2022 BE.”

On the high debt levels due to Covid-19 and populist schemes, M. Govinda Rao, Chief Economic Advisor, Brickwork Ratings said, the debt level in India is high as compared to the level of development of the country.

“However, by and large, the States have adhered to the FRBM borrowing target of 3 per cent of GDP. Thus, populism has not had much of an impact so far as even when some announcements are made, they are diluted while implementing them,” Rao said.

“By and large, the States indebtedness is about 20 per cent of GDP and that is the target given by the 15th Finance Commission for 2025-26.”

Furthermore, he said that centre’s debt has to be sharply brought down from 63 per cent of GDP at present to about 40 per cent which is a tall order.

According to India Ratings and Research, due to Covid induced pressure on both revenue and expenditure, fiscal deficit was higher and hence increased the debt burden in FY21.

“The situation is improving in FY22,” said Anuradha Basumatari, Associate Director, India Ratings and Research.

“Populist schemes have been around and not necessarily a key reason for increase in the debt burden. The increase in debt in FY21 is largely due to impact of Covid on growth and revenue, while also requiring states to undertake expenditure for COVID containment and control.”

Moreover, the agency expects the aggregate fiscal deficit of states for FY23 to come in at 3.6 per cent of the gross domestic product (GDP) compared to 3.5 per cent (revised) in FY22 (forecast).

It had earlier given a forecast for FY22 at 4.1 per cent.

The revision was made due to better-than-expected growth in revenue receipts and higher growth in the nominal GDP in FY22.